Bank of Canada Governor Tiff Macklem and Senior Deputy Governor Carolyn Rogers leave after holding a press conference at the Bank of Canada in Ottawa on Wednesday, July 12, 2023. THE CANADIAN PRESS/Sean Kilpatrick

The Bank of Canada’s interest rate hike on Wednesday and prospects of more increases heighten risks to mortgage lenders as homeowners are likely stay in debt longer, struggling to make higher payments or pay even the interest portion of their home loans, investors and analysts said.

After urging lenders to tackle risks from a sharp rise in borrowing costs, Canada’s main banking regulator, Office of the Superintendent of Financial Institutions (OSFI), on Tuesday proposed tougher capital rules for lenders to prevent consumers from defaulting or entering negative amortization.

Negative amortization occurs when variable home loan customers’ monthly repayments are insufficient to cover the interest component of home loans. The excess amount gets added to the outstanding loan, lengthening the repayment period.

“All of that is a realization that there is stress in the system,” said Greg Taylor, Chief Investment Officer of Purpose Investments.

“There’s definitely more risk because anytime you hike you never know when it’s going to be the straw that breaks the camel’s back.”

Unlike the U.S., where home buyers can snag a 30-year mortgage, Canadian borrowers must renew their mortgages every five years at the prevailing interest rates.

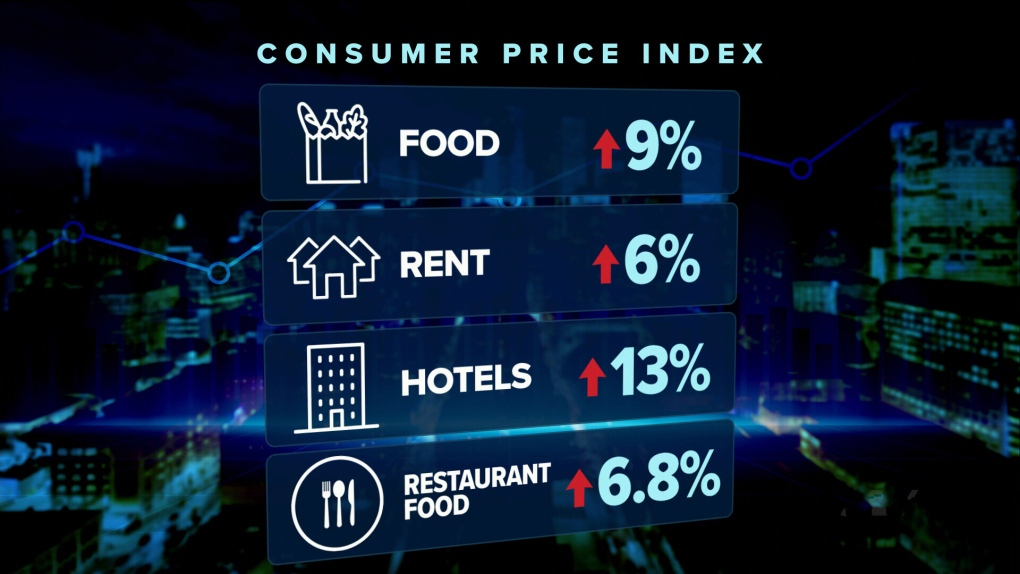

On Wednesday, the central bank pushed back its expectations for getting inflation to its two per cent target by six months to mid-2025, a sign interest rates are likely to stay higher for longer.

The cost of a floating rate mortgage has now increased by about 70 per cent from the loans since October 2021, when interest rates hit a record low and more than half of home buyers took out floating rate loans. Analysts estimate some C$331 billion in mortgages come up for renewal in 2024 and C$352 the following year, illustrating the enormity of refinancing challenge.

Consumers are largely able to make their payments for now, thanks to strong employment. Also, consumers getting mortgages have been stress-tested for higher rates than their original mortgage.

Latest data released during the quarterly earnings showed mortgage delinquencies for all banks were low.

Of the big six banks in Canada, Bank of Nova Scotia and National Bank of Canada do not offer mortgage extensions, meaning the payment owed by the consumer goes up for each hike the BoC announces.

The two banks will be key for any early signs of stress as borrowing costs rise further. Analysts also warned the two banks risk losing mortgage market share due as their products offer less flexibility.

RBC and Scotiabank said it has been working with customers individually and reaching out to customers proactively in the current rising rate environment. National Bank did not offer a comment.

Bank of Montreal, CIBC and TD Bank each allow for negative amortization as rates rise.

More than three-quarters of people with variable-rate mortgages had already hit their trigger rate, according to Desjardins.

Royal Bank of Canada, the country’s biggest bank, does not offer negative amortization but its variable rate mortgage customers have already seen an increase in payments by as much as 40% to cover higher interest rates, KBW analyst Mike Rizvanovic said. While the other three banks have fully insulated their borrowers until the mortgage is renewed.

Canada’s banking regulator’s latest proposal to increase capital requirements puts “modest” challenges on CIBC depending on how much of the portfolio ultimately moves to a negative amortization, Rizvanovic said, adding that BMO and TD would face “a very manageable impact.”

CIBC did not offer an immediate comment.

Darcy Briggs, portfolio manager at Franklin Templeton Canada, said one of the key factors for “keeping persistent demand is mortgage forbearance.”

“If your monthly payment doesn’t change, consumer behaviour doesn’t change so spending habits and patterns don’t change. So it is working counter to what the Bank of Canada is trying to accomplish,” Briggs added.

(Reporting by Nivedita Balu in Toronto; Editing by Josie Kao and David Gregorio)

In recent times, the Bank of Canada’s record tightening campaign has sent shockwaves through the mortgage market, causing lenders to question their confidence in the face of increasing challenges. This article delves into the profound impact of the Bank of Canada’s actions, examining how the tightening measures are unsettling lenders and reverberating throughout the industry. With interest rates rising and stricter lending criteria being enforced, the mortgage landscape is undergoing a significant transformation, leaving lenders and borrowers grappling with uncertainty.

The Bank of Canada’s aggressive tightening campaign has left lenders feeling uneasy as they navigate uncharted territory. Historically low interest rates had fueled a surge in lending and borrowing, with lenders taking on greater risks to accommodate the increased demand. However, as the central bank tightens monetary policy to curb inflation and stabilize the economy, lenders are being forced to reassess their lending practices and risk appetite.

One of the main challenges faced by lenders is the reduction in affordability for borrowers. As interest rates rise, the cost of borrowing increases, making it more difficult for potential homeowners to qualify for mortgages and afford the monthly payments. This tightening of affordability has a direct impact on lenders’ ability to generate new business and maintain profitability. Lenders now face the dilemma of finding a balance between responsible lending and ensuring their own sustainability.

Furthermore, the stricter lending criteria imposed by the Bank of Canada have led to a decline in mortgage approvals. Borrowers who would have previously qualified for a mortgage may now find themselves ineligible under the tightened regulations. This decline in mortgage approvals not only affects lenders’ revenue streams but also has broader implications for the real estate market and the economy as a whole.

The ripple effect of the Bank of Canada’s tightening campaign is evident in the rising number of mortgage delinquencies. As borrowers face increased financial strain due to rising interest rates and reduced affordability, some are struggling to meet their mortgage obligations. This uptick in delinquencies puts additional pressure on lenders, who must now manage the risks associated with higher default rates and potential losses.

In response to the shifting landscape, lenders are reevaluating their risk management strategies and recalibrating their lending practices. This self-reflection is necessary for lenders to adapt to the new environment and mitigate potential risks. They must strike a delicate balance between remaining competitive in the market while maintaining prudence in their lending decisions.

The Bank of Canada’s record tightening campaign has not only shaken lenders’ confidence but has also prompted a broader discussion about the stability of the mortgage market. Industry stakeholders, including lenders, regulators, and policymakers, are closely monitoring the evolving situation to ensure the long-term health and resilience of the housing market.

In conclusion, the Bank of Canada’s record tightening campaign is significantly impacting lenders’ confidence and reshaping the mortgage landscape. Rising interest rates, stricter lending criteria, reduced affordability, and increased mortgage delinquencies are among the challenges lenders are currently grappling with. However, this period of adjustment also presents an opportunity for lenders to reevaluate their risk strategies, enhance responsible lending practices, and adapt to the changing market dynamics. By doing so, lenders can navigate this turbulent period and contribute to a more stable and sustainable mortgage industry in the future.

Embrace Responsible Lending Practices: Focus on lending to borrowers with strong credit profiles and stable income sources. Conduct thorough assessments of borrowers’ financial capabilities and ensure that loans are within their means to repay.

Diversify Loan Portfolios: Explore opportunities to diversify loan portfolios by offering alternative mortgage products or expanding into different market segments. This can help mitigate risks associated with a single type of loan or a specific geographic area.

Enhance Risk Management Strategies: Strengthen risk management protocols to identify and address potential vulnerabilities in the lending process. Regularly assess the creditworthiness of borrowers and closely monitor market trends to proactively manage risks.

Educate Borrowers: Provide comprehensive financial education to borrowers, empowering them to make informed decisions about their mortgage options. Educated borrowers are more likely to understand their financial responsibilities and be proactive in meeting their mortgage obligations.

Collaborate with Regulators: Stay abreast of regulatory changes and engage in open dialogue with regulators to ensure compliance with evolving lending standards. Actively participate in industry discussions and initiatives to shape responsible lending practices.

By implementing these suggestions, lenders can navigate the uncertainties brought about by the Bank of Canada’s tightening campaign, mitigate risks, and maintain confidence in their lending practices. Adaptability, responsible decision-making, and a proactive approach are key to successfully weathering the challenges and emerging stronger in the evolving mortgage landscape.